You’ve seen it before. A client comes to you with a P&L statement showing healthy profits, but their application is stalled or rejected. The feedback is vague: “cash flow concerns,” “financials out of date,” “financials are not reliable.” It’s frustrating for you and devastating for your client.

The reality is, a standard P&L is a dangerously incomplete picture. It’s a historical document that hides the operational risks and cash flow black holes that lenders really care about.

As a broker, moving beyond the P&L and moving into proactive management accounting is your new competitive advantage. It allows you to diagnose your client’s true financial health, provide immense strategic value, and ultimately, bring a de-risked, highly fundable applicant to the table.

Each month, every ABL Corp client receives a tailored Monthly Performance Report packed with insights and metrics that drive results. Here are five key measures we track to assess performance and help you unlock opportunities that others can’t.

1. Gross Profit (GP) Per Project: Exposing Profit Vampires

Your client’s overall GP might look fine, but a single unprofitable project or customer can be a profit vampire, draining cash from the rest of the business.

- What it is: The true profitability of an individual job or service line after all direct costs are removed.

- The Broker’s Advantage: By asking your client about this, you shift the conversation from a simple loan application to a strategic business review. If they don’t know the answer, you’ve identified a critical blind spot. A client who can demonstrate control over their project profitability is a far more attractive credit risk. It’s a clear indicator of strong SME profitability management.

ABL Corp’s Deeper Dive into GP: Our ABL Corp Advisory team can run an Equipment Efficiency Review to improve your client’s overall position. Is their underutilised gear an asset that could be sold to inject cash? Are they hiring equipment when purchasing would radically improve their GP? We find these answers to strengthen your client’s financial position.

2. Customer Concentration Risk: Identifying the Ticking Time Bomb

A client heavily reliant on one or two large customers is a high-risk proposition. What happens if that key account pays late, squeezes the margin or leaves? Every savvy lender will ask this question.

- What it is: The percentage of total revenue and Gross Profit tied to their top clients.

- The Broker’s Advantage: Proactively identifying a concentration risk above 30% allows you to have a crucial conversation with your client about diversification. More importantly, it allows you to partner with a lender like ABL Corp, which specialises in funding high concentrations and progress claims, turning a major red flag for the banks into a fundable scenario.

3. The Cash Flow Trinity: The Ultimate Test

This is where most deals fall apart. Profit doesn’t service debt; cash does. A deep dive into a client’s cash flow analysis reveals their true ability to manage commitments.

- The Metrics:

- Accounts Receivable (AR) Days: How fast they get paid.

- Accounts Payable (AP) Days: How fast they pay suppliers.

- Working Capital Days: The critical gap, in days, that their cash is locked up funding operations.

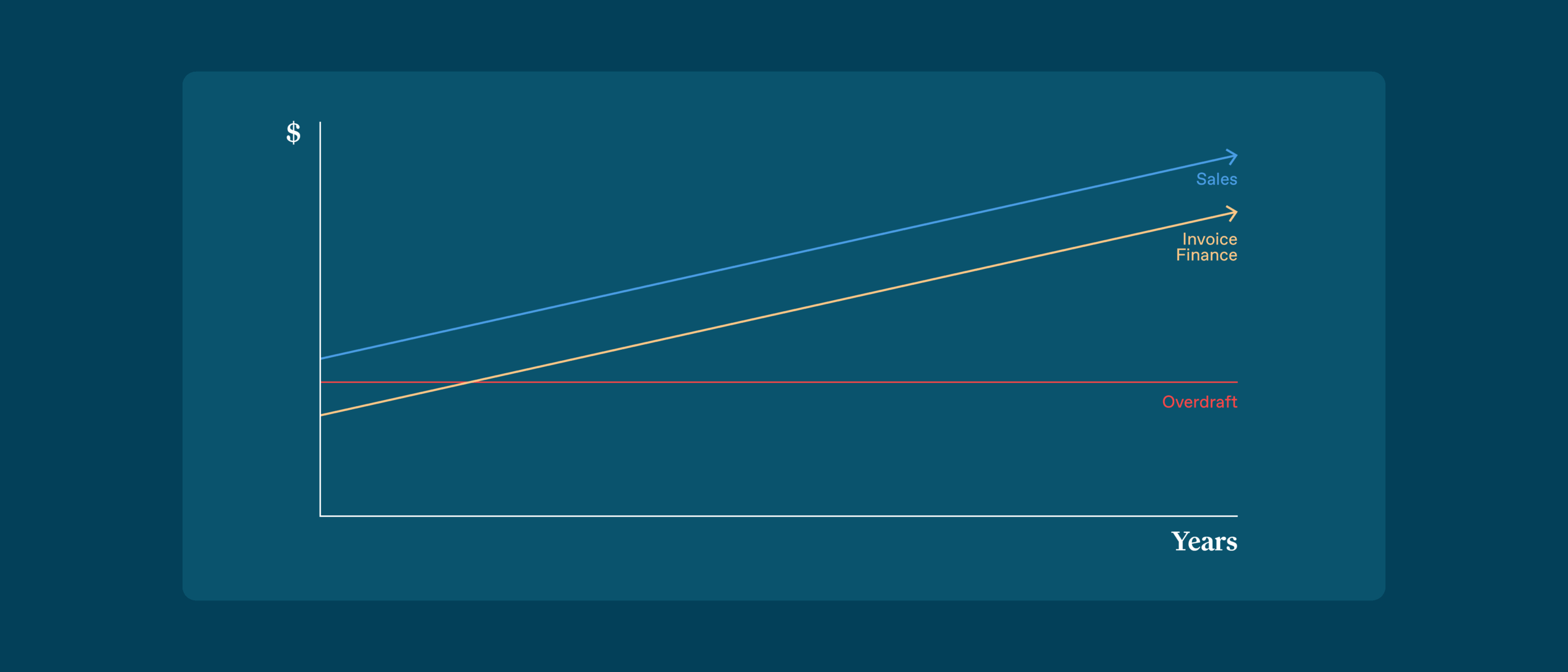

- The Broker’s Advantage: When you see a client with long AR Days or a high Working Capital Days number, you can stop pitching traditional term loans that don’t solve the core problem. You can immediately diagnose the need for a working capital solution. This positions you as a strategic expert and opens the door for a powerful, tailored recommendation.

The Ultimate Solution: This is the textbook scenario for Invoice Finance. You can show your client precisely how an ABL Corp facility will slash their Working Capital Days, injecting immediate, predictable cash flow into their business. It’s a direct solution to the exact problem the banks have identified, making it an easy case to present.

4. Breakeven Analysis: Gauging Operational Resilience

Does your client know the exact sales figure they need to hit each month to avoid losing money? A surprising number don’t. This is their survival number.

- What it is: The point where total revenue equals total costs.

- The Broker’s Advantage: A client who knows and tracks their breakeven point demonstrates a high level of financial maturity. Encouraging them to perform this analysis shows you are invested in their success and resilience. It also gives you confidence that they can weather a slow month without defaulting.

5. Profitability Trends: Spotting Trouble Before It Hits

A single P&L is a snapshot. A trend line tells a story.

- What it is: Tracking Gross Profit % and Net Profit % month-on-month.

- The Broker’s Advantage: Are your clients’ margins slowly eroding as they grow? A downward trend is an early warning sign of pricing pressure or rising costs. By spotting this, you can advise your client to investigate before it becomes a major issue that impacts their serviceability and derails a finance application.

How To Get Started

Understanding these business performance metrics is powerful. Partnering with a team that has this analysis built into its DNA takes it to the next level. The ABL Corp model is designed to support you and your clients in a way no one else can:

- We’ll Make Clients Fundable: Our integrated Bookkeeping and Advisory services take clients with messy or incomplete financials and turn them into organised, de-risked, and attractive applicants. We do the heavy lifting to get them finance-ready.

- We’ll Solve the Core Problem: We don’t just provide a loan. We provide the strategic insight to understand the real issue, and then deliver the right facility (like Invoice Finance) to fix it.

- We’ll Say ‘Yes’ More Often: Because we have this deep, real-time understanding of a business’s health, we see the strength and opportunity where traditional lenders only see risk.

Ready to unlock more approvals? Together, we can get more of your deals across the line.