The Silent Epidemic of the SME Liquidity Squeeze

There’s a lie that’s hurting many SMEs. On the surface, business is vibrant, but underneath is an SME liquidity squeeze keeping them awake at night, threatening the viability of even the most profitable enterprise.

Here’s why, and it’s not their fault –

The cash flow cycle is a systemic problem, and it impacts 80% of Australian SMEs. If your clients are feeling the weight of liquidity pressure, they’re not alone. They are operating within a financial ecosystem that has evolved to create a structural misalignment between their outgoings and their incomings.

The result is a state of business stagnation Australia-wide, where companies that should be growing are instead forced to contract to survive.

This blog gives you a diagnostic and strategic roadmap. We will move beyond superficial Band-Aid fixes to offer a permanent cure and solve SME cash flow problems for good.

Part 1: The Anatomy of the Cash Flow Trap

The Disconnect Between Profit and Cash

One of the most disorienting experiences for an SME owner is to review a Profit and Loss statement that indicates a healthy net profit, only to see a bank balance hovering way too close to zero. This is the fundamental disconnect between profitability and liquidity. Profit is an accounting theory, while cash is the reality of survival.

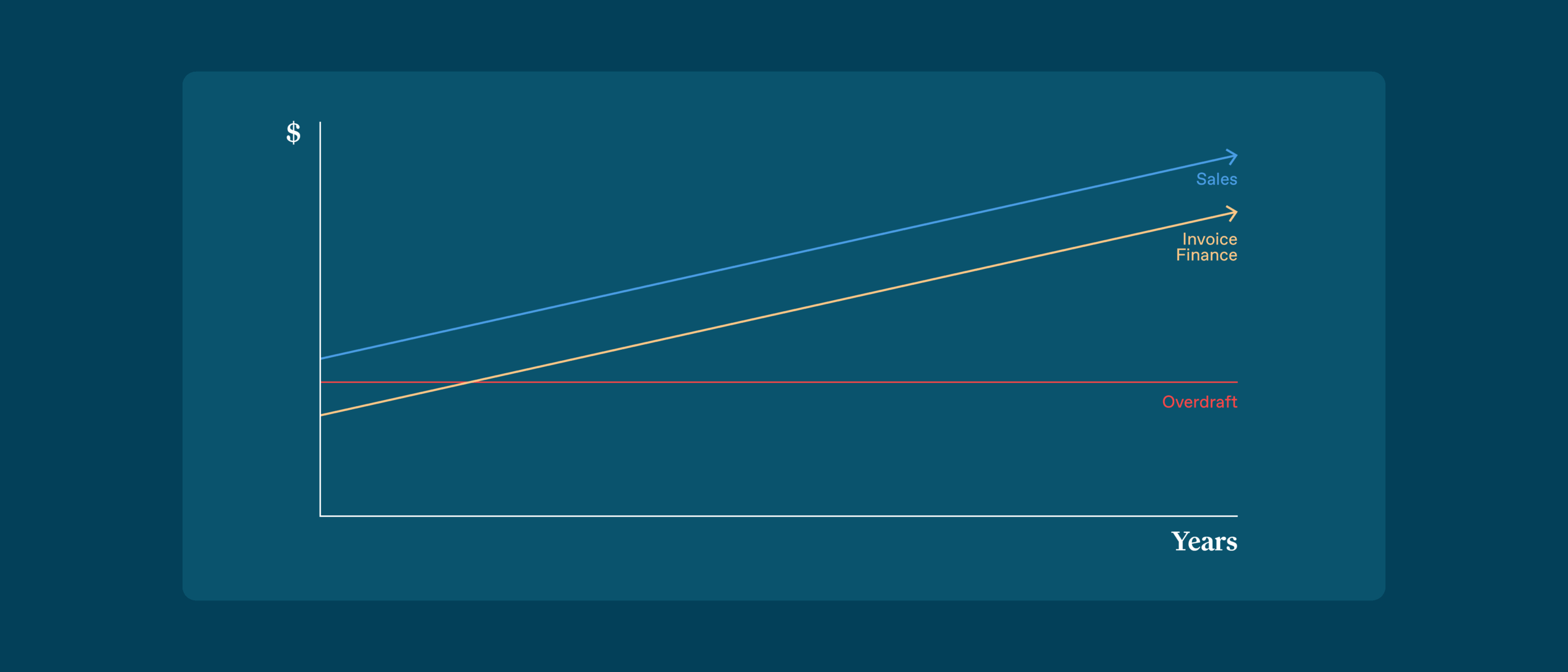

Cash flow management is driven by a timing mismatch. Suppliers and the ATO demand payment on strict schedules, while customers often treat payment terms as suggestions. This creates a funding gap. For every dollar of sales generated, your client’s business must typically fund the costs for nearly two months before realising a return. As a business grows, this cycle expands. A larger order book results in a larger debtors ledger, which traps more capital. Without a strategy to unlock that, capital growth becomes a liability rather than an asset.

The Band-Aid Cycle

When the SME liquidity squeeze tightens, the instinctive reaction is to seek immediate relief. This typically takes the form of one of the following Band-Aid solutions.

The Bank Overdraft:

These are static facilities with hard limits that do not scale with the business. They often require residential property as security, which links their family home to business volatility.

Fintech Loans:

Fintech loans can be an expensive short-term fix, often capping a client’s growth potential and imposing heavy principal repayments that strangle cash flow. It creates a debt spiral that makes it impossible to build small business cash reserves.

The ATO Payment Plan:

Treating the tax office as a bank is dangerous. Recovery actions have resumed aggressively, and this places the business in a precarious legal position.

These methods are reactive, treating the symptom rather than the disease, which has the knock-on effect of higher stress levels and impacts on creative and strategic thinking.

The Three Hidden Gaps

To truly solve SME cash flow problems, we must identify the real causes, and they come in three distinct gaps.

The Strategic Gap (Lack of Forecasting)

Most SMEs drive their business looking in the rear-view mirror using historical data. Without a forward-looking navigation system like a 13-week cash flow forecast, your client cannot predict a liquidity crunch until it is too late.

The Financial Gap (Inflexible Capital):

Traditional banking products are rigid. They do not move in sympathy with the business cycle, which means businesses are often overleveraged in quiet months and undercapitalised in busy ones.

The Efficiency Gap (Inefficient Tech):

Manual processes are the silent killer of cash flow. Errors in data entry and slow invoicing create admin drag that compounds the liquidity squeeze.

Part 2: The Permanent Cure

Rationale dictates that if the problem is systemic, the solution must be holistic. A simple loan cannot fix a strategic failure. ABL Corp has engineered a model that acts as the permanent cure. Unlike traditional lenders who offer money and walk away, ABL Corp integrates Finance, CFO Advisory and Technology into a single ecosystem to completely change the future prospects for your client.

Pillar 1: ABL Corp Finance

The first step is to stabilise working capital. ABL Corp utilises Asset Based Lending to provide dynamic capital that bridges the funding gap without the need for real estate security.

The primary tool to break the invoice cycle is Invoice Finance. Instead of waiting up to 90 days for a customer to pay, ABL Corp advances up to 80% of the invoice value within 24 hours of issue. This converts a credit sale into a cash sale. As sales grow, this facility grows automatically.

By implementing ABL Corp Finance, the immediate pressure of the SME liquidity squeeze evaporates within a finance solution that is designed to grow as your client’s business grows.

Pillar 2: ABL Corp Advisors

Access to money solves the liquidity problem, but it does not solve the strategic problem. ABL Corp Advisors provide CFO Advisory services typically only accessible to large corporations.

An ABL Corp outsourced CFO becomes a partner with you. They build robust 3-way forecasts that allow you to see hurdles months in advance. This transforms cash flow management from a reactive panic into a proactive discipline.

One of the primary mandates of the ABL Corp Advisory service is to help your client’s business build cash reserves. By optimising pricing and controlling costs, you can start to accumulate reserves that ensure long-term stability.

Pillar 3: ABL Corp Technology

The third leg of the stool is Technology. Cash flow management strategies that leading Australian businesses use must include digital transformation. ABL Corp Technology automates the processes that clog cash flow arteries.

This involves integrating our in-house bookkeeping service and monthly management reporting for real-time data that drives forecasting and strategic growth decisions.

When Finance, Advisory and Technology are integrated, your clients move from flying blind to flying with a sophisticated dashboard.

Part 3: The 3-Step Plan to Break Cash Flow Stress for Good

How does your client transition from chaos to control? They follow a clear 3-step process designed to solve SME cash flow problems permanently.

Step 1: Stabilise (The Financial Reset)

Objective: Stop the bleeding and secure immediate liquidity.

Action: Engage ABL Corp Finance to assess your client’s asset base, including Debtors, Inventory and Equipment.

Result: Replacement of rigid overdrafts with a flexible facility. Immediately unlock up to 80% of the cash tied up in unpaid invoices. The pressure to pay wages vanishes, and they have the working capital required to operate without stress. This hits the reset button on the cash cycle.

Step 2: Strategise (The CFO Roadmap)

Objective: Ensure the new capital is used to drive profit.

Action: Engage an ABL Corp outsourced CFO to review financial health and build a rolling forecast.

Result: Your client’s business moves from reactive to proactive. You know exactly how much cash is needed for the next quarter. We have identified whether the issue is pricing or stock turnover and provide expert guidance to fix it. This is where your client begins to build small business cash reserves.

Step 3: Systematise (The Technological Lock-In)

Objective: Automate success and prevent sliding back into old habits.

Action: Deploy ABL Corp to streamline operations.

Result: Your client’s business now runs efficiently. Administrative costs drop, and errors are eliminated. The cash flow machine runs in the background, requiring supervision rather than manual cranking.

Transforming Your Client’s Business with ABL Corp

Many Australian SMEs hit a glass ceiling where they cannot grow past a certain revenue point. This is the heart of business stagnation in Australia. The cause is almost always the limitations of financial resources.

The narrative of the struggling Aussie battler is unnecessary. Your clients do not have to be part of the 80% statistic. The SME liquidity squeeze is a solved problem.

ABL Corp represents the evolution of SME finance. It is the recognition that a simple loan is just a Band-Aid, but a holistic ecosystem is a cure. Whether your client needs to stabilise their ship or speed towards a new horizon, our integrated team is ready.