There’s cash flow hidden in your unpaid invoices that you might be able to capture. If you run a small or medium-sized business in Australia, you know the feeling: you’ve done the work, delivered the goods, and sent the invoice, but your bank account doesn’t reflect your hard work.

If you’re profitable on paper, but constantly chasing payments to cover wages, suppliers, and rent, you’re not alone – 80% of Australian SMEs face significant cash flow challenges.

But your opportunity is this: with almost half of all payments made to small businesses being late (typically fluctuating from 49-55 days), invoice financing can fill the gap between earning revenue and getting the cash.

This guide will unpack invoice funding, explaining how it works, who it’s for, and how ABL Corp can help you transform your cash flow from a source of stress into a strategic asset.

What is Invoice Financing?

Invoice financing is a powerful financial tool that gives you immediate access to the cash tied up in your unpaid customer invoices. Instead of waiting 30, 60, or even 90 days for a client to pay, a specialist finance partner like ABL Corp can advance you a significant portion of the invoice’s value (typically up to 85%), often within 24 hours.

Once your client pays the invoice in full, you receive the remaining balance, minus a service fee. It’s not a traditional loan; you are leveraging your accounts receivable to access the money you have already earned, faster. Think of it as a flexible line of credit that is directly linked to your growth and cash needs. It’s one of the most effective working capital loans available for small businesses.

How the ABL Corp Process Works

At ABL Corp, we’ve streamlined our process for speed and simplicity because we know that when you need cash flow, you need it now.

- You raise an invoice for goods delivered or services performed.

- ABL provides you with 85% of the value of that invoice within 24 hours.

- When your customer pays (the average in Australia is 52 days), you receive the balance of 20%, less a small fee.

Who Benefits Most from Invoice Financing?

Invoice financing in Australia is particularly effective for B2B businesses that have reliable clients but suffer from long or unpredictable payment cycles. While it can benefit a wide range of companies, it is especially powerful for industries like:

- Manufacturing and Wholesale Trade: To manage high overheads and long payment terms that are standard in the sector.

- Construction and Trades: To cover the significant upfront costs of materials and labour while waiting for progress claims to be approved.

- Recruitment and Professional Services: To bridge the gap between paying contractors and receiving client payments, which often have long cycles.

- Transport and Logistics: To manage fuel, maintenance, and wage costs while waiting for freight invoices to be settled.

Real-World Success Story: Lockyer Valley Waste Management

For a seasoned business owner like John Schollick, with 58 years of industry experience, being held back by inconsistent cash flow was a major frustration. Opportunities were being missed because the capital needed for essential equipment was tied up, and he found the rigid structures of traditional banking were hindering his ability to grow.

The solution was a true financial partnership. ABL Corp implemented a tailored invoice finance facility that immediately solved the cash flow problem. This crucial first step then enabled John to access the equipment finance he required to modernise and expand his operations.

The impact was immediate and significant. As John puts it:

“I’ve been in business 58 years, and no one does it better than ABL Corp. They’ve got a big fan in me as they are professional, quick and always there to help us. Whatever we need, it’s done… Since we started using them, we have had a 55% increase in turnover. We’re aiming for 100% this year, and we’ll get it.”

The ABL Corp Advantage: A True Partnership Approach

When you partner with ABL Corp, you get more than just a lender; you gain a dedicated finance partner invested in your success. Our ability to provide effective funding solutions comes from a deeper understanding of your business’s complete financial landscape.

- Funding Backed by Deep Financial Insight: The reason we can often provide funding when traditional banks can’t is because of our integrated approach. Through our ABL Advisors team, we can offer Bookkeeping and CFO Support & Guidance. This gives us a real-time, comprehensive view of your business’s financial health. We see the full picture, not just a snapshot, allowing us to manage risk more effectively and recognise the true strength of your operation.

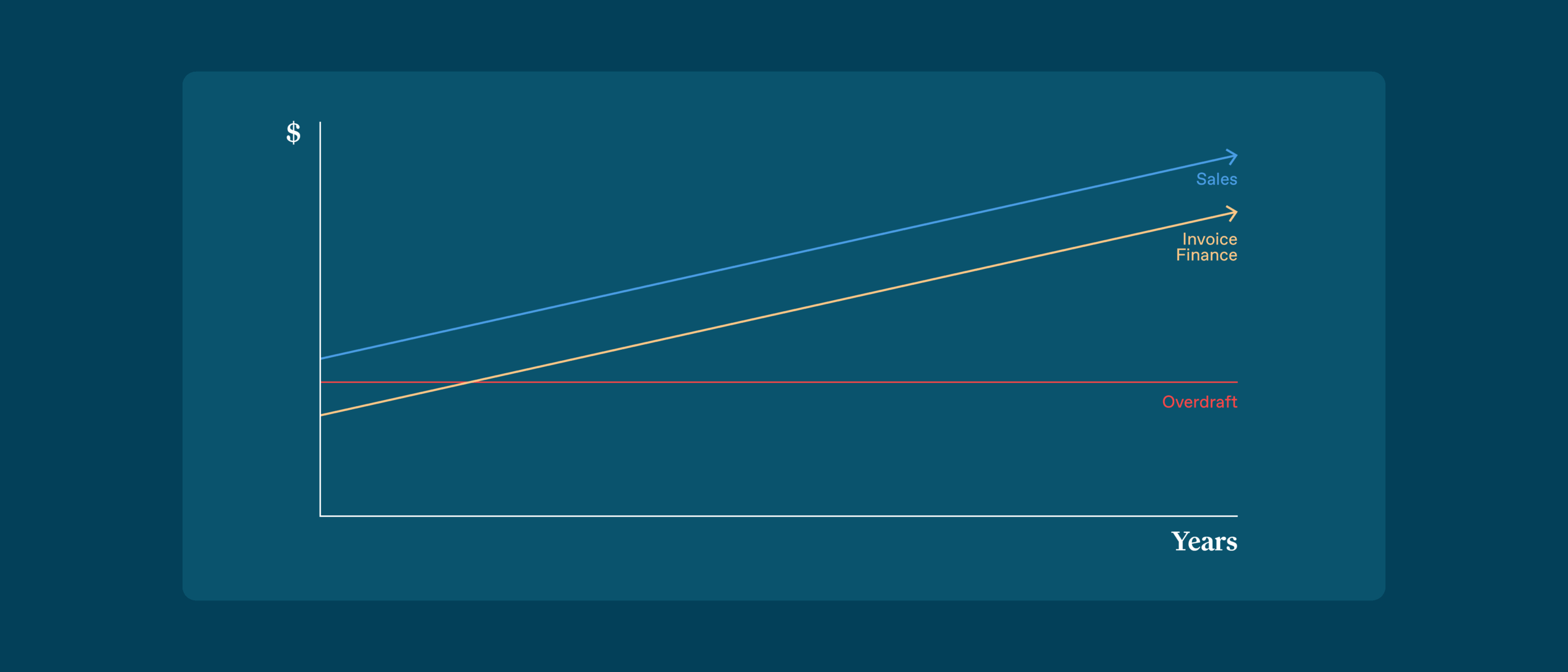

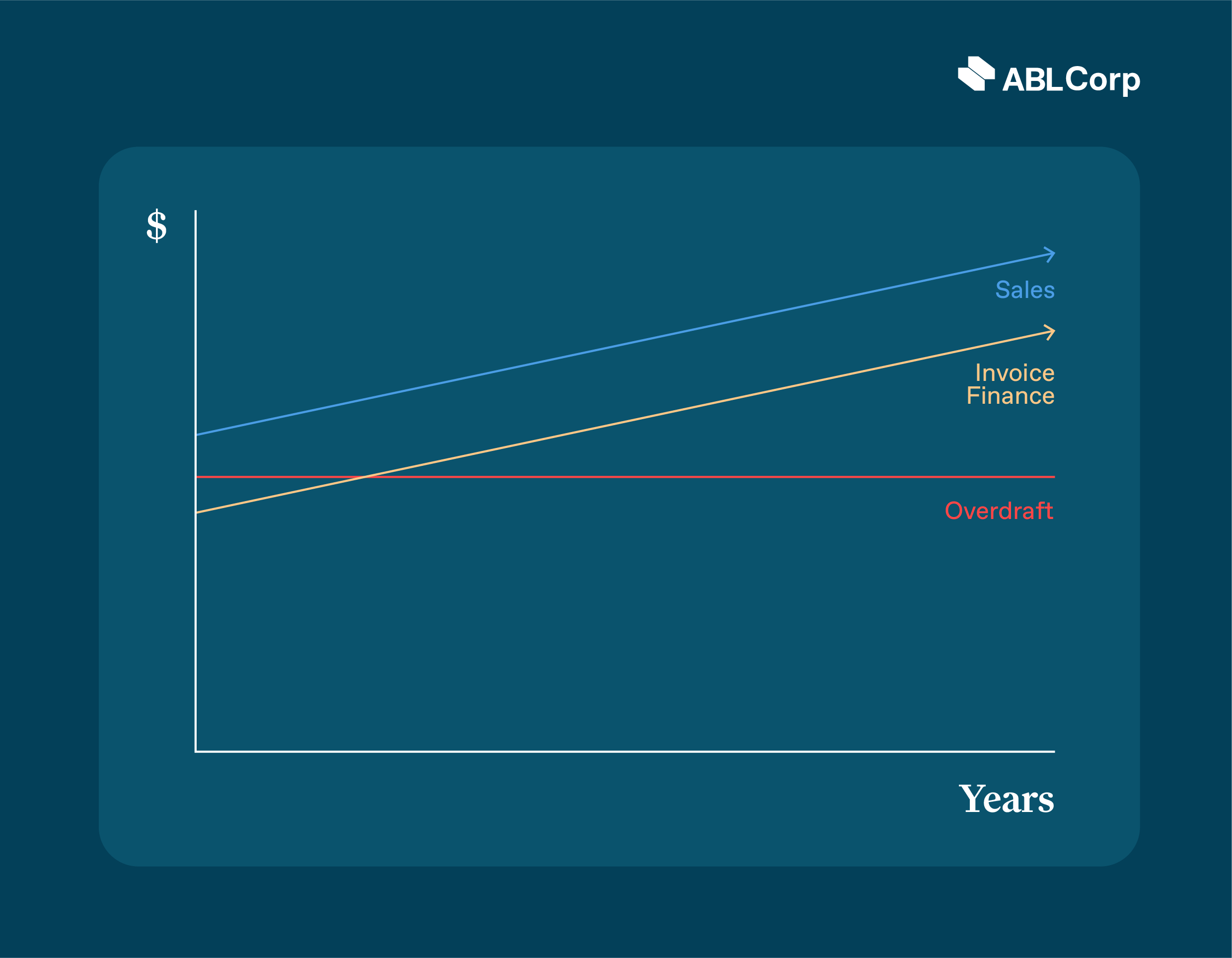

- A Line of Credit That Grows With Your Business: As your business grows, so does the need for cash flow. Invoice financing grows in line with your sales. This is a crucial difference from a traditional bank overdraft, which is typically a fixed dollar amount linked to the amount of real estate security provided. Invoice financing is a dynamic line of credit linked to your growth.

- Security from Your Business, Not Your Home: Our facilities are secured by the assets on your balance sheet (your invoices), not the family home. This protects your personal assets and gives you the confidence to grow your business without putting your personal property at risk.

- Solves Your Immediate Cash Flow Problem: Our solutions close the gap between invoicing and payment, providing the stability you need to plan for the future.

If your business is being held back by slow-paying customers, you can stop waiting and take control. Explore how invoice financing in Australia can provide the liquidity and stability you need to not only survive but thrive. As a flexible non-bank lender, at ABL Corp, we offer facilities with no minimum term or break fees, while also specialising in funding progress claims and high concentrations (even if you have only one or two major customers), without the restrictions you might find elsewhere.

Unlock the cash tied up in your accounts receivable today. Learn more about ABL Corp’s flexible Invoice Financing solutions.

Frequently Asked Questions (FAQs)

Q: Will my customers know I am using invoice financing?

A: Our invoice financing facilities are designed to be completely confidential. The arrangement operates discreetly in the background, so your customers continue to deal with you as they always have. We believe you should always be in control of your client communications; our role is to provide the financial support you need with the absolute discretion you expect from a dedicated finance partner.

Q: Is invoice financing expensive?

A: The cost is a small, transparent percentage of the invoice value. When you weigh this against the cost of missed growth opportunities, the stress of chasing payments, or the damage to supplier relationships from paying late, it can be a highly cost-effective strategic tool.

Q: What’s the difference between invoice financing and invoice factoring?

A: The terms are often used interchangeably. Traditionally, factoring can involve the finance company managing your collections. At ABL Corp, we focus on partnership. We provide flexible invoice financing solutions that give you the cash you need while allowing you to maintain control of your customer relationships.