You’ve got the client. You’ve got the deal. But the financials are a mess. So you are back here, searching for a low doc business loan or a lender who will accept business loans based on bank statements.

It is the industry’s go-to band-aid, a short-term workaround for a much deeper, more frustrating problem.

Your client’s application for a traditional loan was rejected, and the culprit is almost always the same: a “bad” tax return that is the result of… perfectly good accounting.

This article is not just another product page. It is a new strategy. It is how you stop searching for one-off funding solutions for low taxable income and start building a pipeline of premium, bank-ready clients.

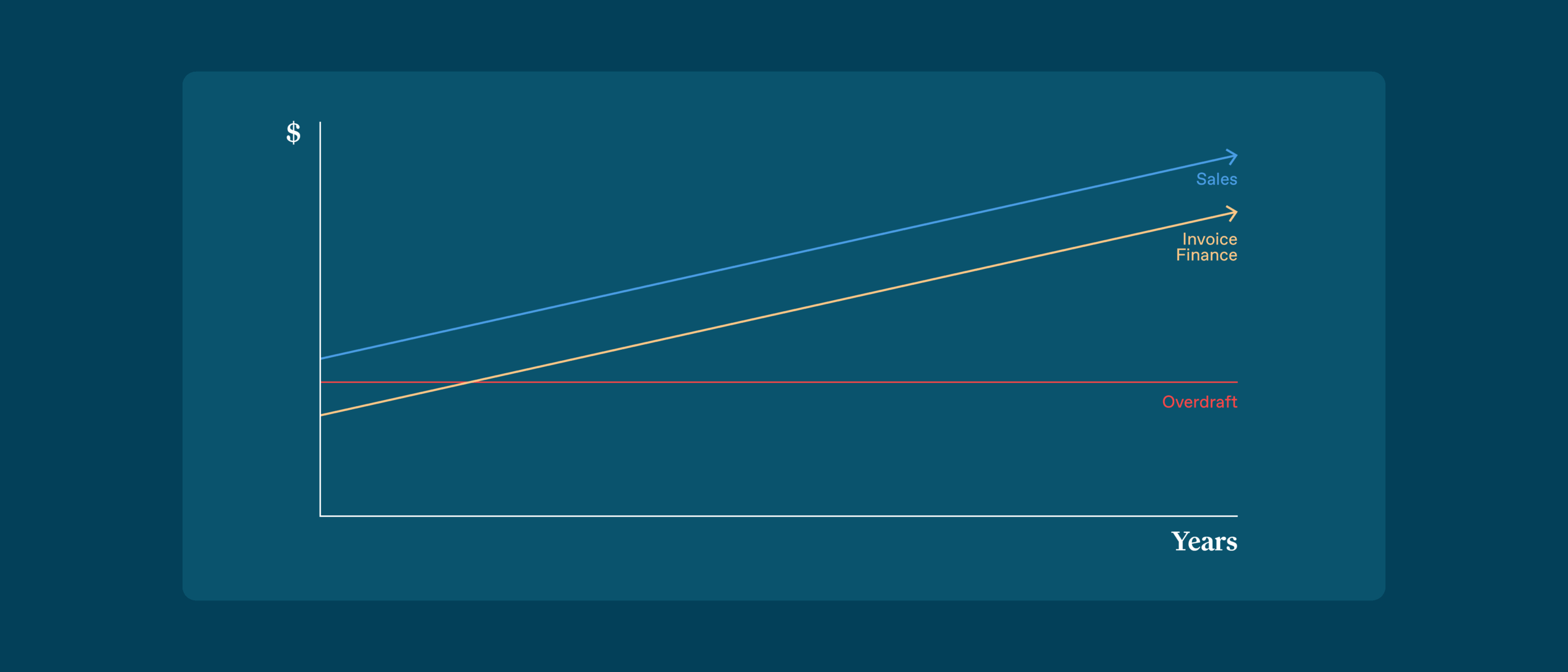

The “Band-Aid” Cycle That’s Costing You Deals

Let’s call this frustrating cycle what it is: an “Accountant vs. Broker” conflict.

It plays out every single day. The accountant does their job brilliantly. They (correctly) use every available strategy to minimise their client’s taxable income. The broker then takes these financials to a lender, who (correctly) rejects the application based on serviceability. This is the core reason for so many commercial loans to be rejected. You could also be dealing with the common problem where a client doesn’t have accurate and timely management accounts. This delays and jeopardises the loan application process.

So you end up trying to save the deal by finding a specialist non-bank lender who will accept business loans based on bank statements or find other ways to approve the finance.

A simple low doc business loan might save this one deal, but it does not fix your client’s problem so you’ll end up in the same position in 12 months, solving the exact same problem. It is a short-term workaround, and it is capping your client’s (and your) potential. Not only that, they are expensive and often register a charge against all business assets (AIIPAP or General Security Deed), which limits the client’s future borrowing options.

The Cure: How ABL Corp Makes Your Clients ‘Finance-Ready‘

What if, instead of just finding a band-aid, you could offer a structural cure?

At ABL Corp, we have built the solution. We have seen this structural gap in the industry for years, which is why we created our unique model that explains exactly how to get broker clients finance-ready.

Instead of just one product, we provide an integrated, three-pillar solution that fixes your client’s underlying problems for good.

- The Finance Pillar (The Immediate Fix)

Our Finance pillar provides the fast, flexible capital to save the deal right now. This is the solution you were looking for, but for ABL Corp, it is just step one. - The Bookkeeping Pillar (The Foundation)

This is a client’s link to finance and accurate forecasting. With our deep insight into their true financial position, we reduce risk and are, therefore, able to lend where others often can’t. As a single source of truth, it becomes the critical step that allows our CFOs to stop cleaning up the past and start accurately forecasting the future. - The CFO Advisory Pillar (The Strategic Cure)

Next, our CFO Advisory team gets to work. Our outsourced CFOs work with the accountant to build a long-term, bank-ready financial strategy. We clean up the client’s data, build accurate forecasts, and create a clear financial narrative that banks want to see.

With a technology pillar in a supporting role, we can ensure the strategy is built on rock, not sand. Our team solidifies a client’s underlying IT infrastructure and data processes. Once secure and reliable, we can be confident that the financial models our CFOs build are accurate and trustworthy.

From “Unfundable” to “Premium”: Your New Business Model

This is what transforms your business model.

When you partner with ABL Corp, you stop being a transactional broker looking for one-off, low-doc business loans. You become a long-term strategic advisor who genuinely solves your client’s deepest financial problems, where an unfundable client becomes a premium one. The next time they need finance, they will be bank-ready, with clean financials, a clear strategy, and a history of success.

This is the future of strategic partnerships for finance brokers. Instead of being just another non-bank lender broker program, we are a partner in your client’s long-term success.

No Need For Band-Aids. Start Offering Cures.

Give your clients the complete structural solution they actually need to thrive with ABL Corp’s model.

Download our free Educational Guide for Finance Brokers today and learn how to close more deals.